Navigating the world of mortgage brokers can be challenging, but also for eligible veterans and energetic-responsibility services players, the fresh Virtual assistant mortgage program has the benefit of a possibility to achieve the think of homeownership. One important aspect having obtaining a great Virtual assistant financing is the Certification regarding Eligibility (COE). Many possible Virtual assistant mortgage candidates inquire if the the selected financial can be assist all of them in acquiring it very important file. In this post, we shall simplycashadvance.net/loans/emergency-payday-loan/ mention precisely what the Certification out-of Qualifications are, why it’s needed, and you can in the event the Virtual assistant loan bank makes it possible to safer they.

Understanding the Certification away from Qualifications (COE)

This new Certification out of Qualification, often referred to as the fresh COE, are a basic document throughout the Va application for the loan procedure. It functions as proof you meet the qualifications requirements set forward by Agencies out of Experts Factors (VA) so you’re able to qualify for a good Va home loan. The COE basically certifies that you have the required armed forces services or is actually an experienced thriving companion becoming felt getting a beneficial Virtual assistant financing.

Why is the fresh COE Required?

Proof Qualifications: Brand new COE are a means on the Va to confirm that your meet with the provider criteria getting good Virtual assistant loan. This can include their lifetime of services, whether you’re discharged below honorable conditions, or other situations you to definitely introduce their qualifications.

Determining Financing Guaranty: The newest COE in addition to specifies the newest VA’s guaranty matter for the loan, and that influences the brand new fine print of one’s financing, for instance the down payment and you will rate of interest. They essentially informs loan providers how much of the mortgage they are able to expect you’ll become supported by the Va in the eventuality of default.

Avoiding Delays: Getting the COE at your fingertips before you apply to own good Va mortgage normally improve the procedure and get away from unnecessary delays. It will help loan providers establish the eligibility quickly, deciding to make the application process smoother.

Given that we all know the importance of the COE let us delve to the in the event your Va mortgage financial can assist you inside obtaining they.

Normally The Virtual assistant Financing Lender Get your COE to you personally?

Yes, their Virtual assistant financing lender can simply help you in getting your own Certification of Eligibility, although process is initiated by you, the borrower. Here’s how they typically really works:

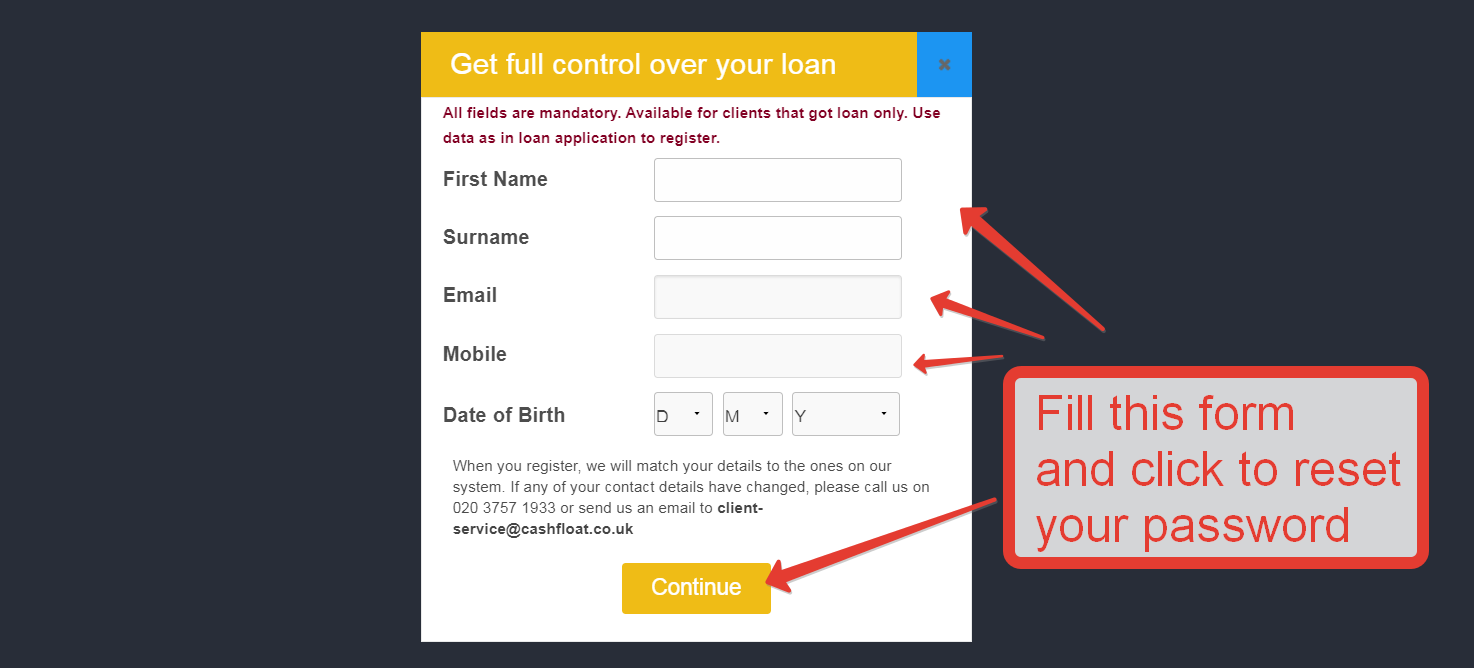

- Use Via your Lender: When you decide to use a Virtual assistant mortgage to order an excellent household, your lender will help you start the COE software techniques. They could provide you with the necessary versions and suggestions to start.

- Online App: Typically the most popular and you will convenient answer to get their COE is online from VA’s eBenefits portal or even the VA’s certified site. Your financial normally assist you to the where to find the applying and how to done they.

- Papers App: In some instances, you will need add a paper software. The financial can supply you with the brand new report setting and you can recommendations on the the best places to upload it.

- Lender’s Recommendations: Whenever you are your own bank cannot myself see your own COE to you, they are able to help assists the method of the communicating with the fresh Va on your behalf and you can ensuring that the job is complete and you will particular.

- Anticipate Operating: Once you complete their COE application, you’ll want to anticipate it to be canned from the Va. The fresh new operating time can differ, however your bank could keep you advised regarding advances.

- Receive Their COE: As soon as your COE is approved, you will get it sometimes electronically or from the send. The financial requires a copy associated with file to go submit along with your Va loan application.

It is critical to keep in mind that if you’re your own financial can assist you on COE application process, they can not verify approval or facilitate the new VA’s running minutes. While doing so, this new Va may need additional files to determine their qualifications, just like your armed forces services records otherwise launch files. Your bank normally direct you on which documents are essential.

To summarize, their Virtual assistant loan lender can also be actually help you in acquiring your Certification out-of Eligibility, an important file regarding Virtual assistant home loan application process. Due to the fact responsibility for trying to get the brand new COE eventually drops for the your, your financial also have pointers, help, and ensure that your application is done and specific. The fresh COE is a critical part of protecting good Va mortgage, along with the correct lender with you, you will be well on your way in order to reaching the homeownership requirements because the a worthwhile veteran or effective-duty service representative.