In a situation out-of monetary you prefer, some body, along with Domestic Depot experts, can find themselves given taking out financing off their 401(k) account. This article will look into several options that bring brief access to cash when you are safeguarding the newest stability of retirement deals.

From the investigating these types of options, anybody drawing near to later years otherwise currently retired can make advised conclusion one is related and you can tailored on the certain things. It is vital in order to focus on this new conservation and you can development of later years money whilst addressing immediate monetary demands. By the understanding the various possibilities readily available, some one normally strike an equilibrium between being able to access expected finance and keeping the brand new long-term stability of its old-age discounts.

not, it is very important talk about solutions to help you 401(k) money, as they can offer far more professionals to suit your specific issues and long-identity requires

Centered on present lookup in the Financing Business Institute (ICI), over eight in the ten experts have the option for taking aside a beneficial 401(k) financing. Truth be told, however, less than one or two within the ten individuals with that one had put it by the payday loans Feather Sound end regarding 2020. This means that that folks are either conscious of the possibility disadvantages regarding 401(k) loans otherwise may require a much bigger fund than what a 401(k) mortgage also have.

One to limitation away from 401(k) financing is because they try susceptible to Internal revenue service statutes, and this limit plan loans on fifty% of vested balance or $fifty,000, any is shorter. As an example, whether your 401(k) harmony is approximately brand new median property value $18,000, you’ll just be in a position to acquire $9,000. Furthermore, the common outstanding balance regarding 401(k) financing at the end of 2020 is less than $8,000, to your median being only more $cuatro,000. And therefore, the quantity available because of an excellent 401(k) loan might not be sufficient for the financial requires.

Liquidate Organization Inventory: If you keep team inventory from a member of staff stock get package (ESPP), selling it does present quick loans. On top of that, ceasing contributions into ESPP can increase their bring-home pay. It is important to take into account the taxation ramifications regarding promoting team stock, due to the fact gains increase your own goverment tax bill, if you’re losings could possibly get expose an opportunity for income tax-losings picking. Short-term financial support development taxation costs commonly apply at stocks owned to possess 12 months otherwise less, which are generally more than a lot of time-name pricing.

Liquidate Almost every other Property: For those who have property such as brings, bonds, otherwise cryptocurrencies for the a taxable brokerage account, promoting all of them can also be build cash. Always check out the taxation effects regarding offering these assets. Promoting low-monetary property, particularly empty things otherwise collectibles, also can render an alternative source of fund. Just remember that , specific payment applications instance PayPal and you can Venmo today point 1099-Ks, therefore it is more difficult to end reporting progress toward Irs. As well, antiques are subject to higher capital gains tax prices.

Explore Personal loans: If you don’t have possessions to market or if promoting all of them isnt a logical choices, personal loans can offer an alternative choice to 401(k) finance. Such funds are suitable or even very own a house otherwise run out of enough guarantee to help you borrow against. One or two choices to consider is 0% Annual percentage rate credit cards and personal money.

Clean out Retirement Contributions: While this option won’t produce a primary lump sum payment, it does take back month-to-month cashflow which are often designated someplace else

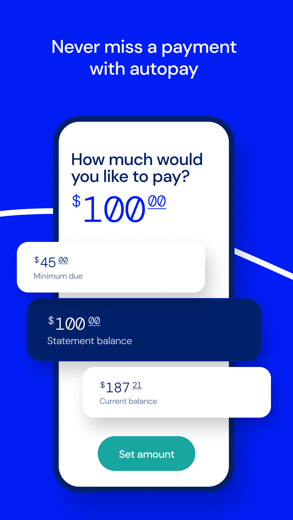

0% Annual percentage rate Credit cards: Going for good 0% Annual percentage rate mastercard enables you to make purchases without having to pay notice to have a selected months, generally at the least one year, as long as you build your minimum monthly payments promptly. Any of these cards include extra masters instance no yearly fees and you may indication-up incentives. However, not paying off of the balance through to the introductory months ends or forgotten a payment will result in appeal costs that you will definitely go beyond those of good 401(k) mortgage. This package is appropriate for many who was disciplined and you will well-structured inside dealing with its funds.