Prior to refinancing your property financing

Refinancing your property loan would be a powerful way to simplify your debt and you will spend less on interest.Before switching, here are a couple things to consider.

Wanting a much better rate of interest? Usage of guarantee? Or possibly debt consolidating? Taking sure of the reasons for having refinancing your house loan commonly help you make the best choice.

According to the bank and unit you select, you might have to pay break costs for individuals who re-finance when you look at the the near future, otherwise software, valuation and you can institution costs. You really need to cautiously think any charges before choosing an alternative home mortgage.

Examining your loan balance and getting a quote of one’s worth in your home can help you to estimate just how much collateral you have on your assets. You can always need certainly to acquire below 80% of property value the property (according to research by the lender’s valuation) to avoid investing lenders’ financial insurance rates (LMI).

There are a number off financing have and you can interest levels one you will see your own refinancing means – both at the Qudos Financial with other loan providers. Do your research locate financing that meets your financial factors.

Ready, place – refinance.

We love championing people – now and into the future. It’s why we were entitled Buyers-Possessed Financial of the year in 2023 from the each other Canstar and you will Mozo’s Experts Choices Awards.

Thus, whether you are trying to upsize, downsize, upgrade or get a good package – Qudos Lender has arrived to greatly help. Our product range are filled up with special features, made to succeed very easy to option.

Prefer a refinance loan solution and no yearly charge without membership staying charge*. That’s money back on your own pouch.

Generate extra repayments on no extra pricing (around $ten,000 a-year for fixed price home loans) and you can pay your property loan smaller.

The calculator tools helps you opt for the home mortgage refinance loan which is effectively for you. To learn more certain on the needs, speak to one of the Credit Professionals.

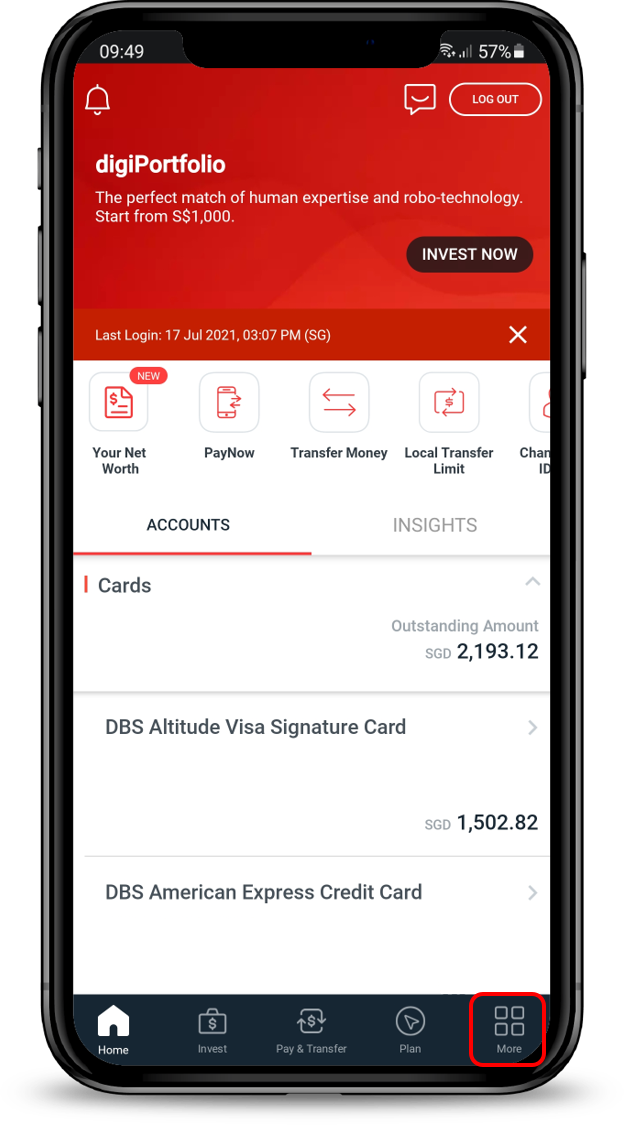

Within clicks, you can start the application on the web. With ease publish all of the called for guidance and you may documents thanks to our very own electronic software in only 10-ten full minutes.

Sit back and you may relax while we review the job and verify your term securely as a consequence of the electronic platform. You could potentially song the brand new advances of the app having fun with all of our tracking function.

When we features what we should you prefer, we can asses the application. If for example the financing is approved, you’ll get an effective conditional recognition within this step three working days.

When your refinanced loan has been acknowledged, meticulously take a look at the the fresh new financing agreements and you will terms and conditions just before signing and you will going back the newest records so you can united states.

During the payment the mortgage proceeds was reduced to the outbound bank, to repay your existing financing. Upcoming all that is kept is actually for us to commercially check in the new home loan with us.

We’re happy to give many mortgage refinance also offers. Whether you’re trying to lock in a predetermined rate of interest to own confidence out of money otherwise enjoy more economic liberty which have flexible financing possess, there is certainly home financing re-finance render to suit your needs.

Zero Frills Home loan

- Low adjustable interest

- Limitless extra money

- Instantaneous redraw

Low cost Mortgage

- Several offset membership

- Limitless a lot more money

- Zero ongoing lender charges

step three Season Repaired Rates Financial

- Repaired rate of interest

- Separated fund readily available

- A lot more money doing $ten,000 annually

Lenders financial insurance is necessary for home loans over 80% LVR which will be susceptible to acceptance. T&Cs, fees, fees and you will financing requirements incorporate. Rates shown significantly more than are offered for the fresh new owner-occupier borrowings out-of $150,000 as well as having dominant and you will appeal payments and you can at least deposit away from 29% to have Inexpensive no Frills loans Oakland IA Home loans and 20% toward step three Season Repaired Mortgage. Investment funds, interest only repayments and you can deposits from below this type of amounts is actually available for certain fund (susceptible to acceptance). Different rates pertain. Contact us for lots more facts.