Increasing home prices for the past while have caused an enthusiastic interesting complication home owners discovered on their own having even more family guarantee.

Household collateral is the difference in your house’s well worth as well as how far you continue to are obligated to pay on your own mortgage. Eg, when your home is really worth $three hundred,000, and also you are obligated to pay $50,000 on your financial, you may have $250,000 inside collateral.

Anybody who possess property has some quantity of security. Whether the property is ordered totally with dollars or a home loan (paid otherwise nonetheless investing), you have security of your property. For folks who get a house having a mortgage, your own down-payment is the first security you build on the household. Because of this homeownership is considered a financial investment or riches-strengthening house.

Just how are House Security Used?

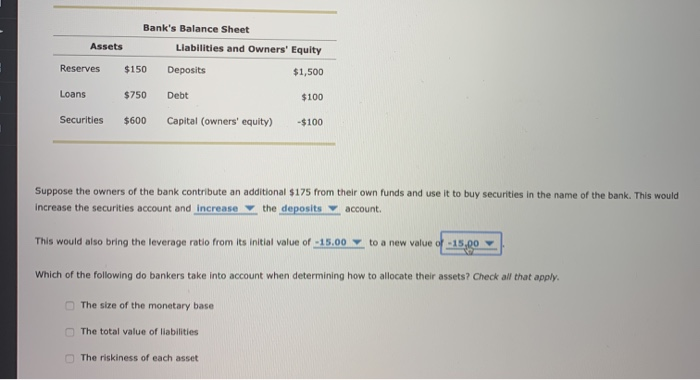

There isn’t any needs to make use of your home’s security after all, but it can be a helpful monetary option for those appearing to attain high goals. Domestic guarantee money offer less interest rate and better financing amount than might normally rating regarding a personal bank loan. It is because a home collateral financing spends your home since the equity, cutting chance with the bank.

If you are there are many more a method to borrow money, they often started from the increased prices. You might also fool around with bucks, but cleaning out your discounts otherwise borrowing from the bank from the funding account can also be run you for your future.

House Guarantee Personal line of credit (HELOC)

A line of credit operates similarly to a charge card. It is an excellent rotating credit line one to allows you to obtain as required. If you are planning to have several expenses during a period of date, a good HELOC get most readily useful work for you.

How it works: An excellent HELOC is actually put into a couple phase. The original phase will be your mark period, whenever you can borrow from the line of credit as soon as you you need to help you. Paying off your balance during this time period renews the financing available. The fresh new draw months was followed by an installment several months, where you are able to no longer draw out of your HELOC and can pay off the final harmony on your personal line of credit.

Remember: HELOCs often have couple if any closing costs, and this conserves currency upfront. Just remember that , these types of credit lines will often have adjustable attention rates. Your own borrowing from the bank costs you will increase if the rates go up.

Home Equity Financing

The way it operates: A property security loan work same as a home loan and other mortgage. You will get the funds upfront and you will pay off their loan’s principal including demand for monthly payments.

Perfect for: Buying one big debts, such as for instance a cooking area restoration otherwise debt consolidation. Due to the fact a fees financing that usually keeps a predetermined interest rate, property guarantee mortgage have predictable payments that produce budgeting much easier.

Keep in mind: By taking aside property security loan when you’re however using off most of your home loan, so it 2nd financing may have a top interest than the first-mortgage.

Make use of your Guarantee to fund Do it yourself Tactics

To continue strengthening guarantee of your house, do-it-yourself systems that improve the value try a sound financial support. Highest do it yourself ideas, like a cooking area remodel, in-law room, completed loft otherwise cellar, or any other preferred enhancements can enhance domestic worth.

- Kitchen: $ten,000-$50,000, mediocre away from $20,474

- Bathroom: $nine,000-$20,000

- $4,400 to have wood, $dos,800 having laminate

- Windows: $8,500 to have plastic, $20,000 having personal loans for bad credit Connecticut wood getting ten window and you will structures

- Roof: $20,000

- Exterior exterior: $fourteen,000

- Company will cost you: 10-15% of project’s total cost

If you are attempting to make updates to your house as opposed to breaking the bank, here are a few these types of 7 Do-it-yourself Methods that wont Break the newest Financial.

Use your Equity so you’re able to Consolidate Loans

In case the objective should be to conserve unlike invest, with your family equity in order to combine large expenses helps you reduce focus and you can clear up monthly premiums. When combining debt, look at the interest rate of one’s loans or expenses to-be consolidated, the reason of these debt, and you may whether or not the collateral may be worth the risk.

Regarding using family collateral to have debt consolidating, you are with your family because security. This is not a matter you need to take softly, especially if the personal debt becoming consolidated is the outcome of mismanaged purchasing otherwise cost management.

Get started Today

We’ll help to really make the techniques because the much easier and affordable that you could. Check out Western Lifestyle Borrowing Union’s competitive home guarantee solutions and you can with ease apply online. E mail us at any time that have inquiries.