Strengthening your own custom-built home in Colorado are a dream for of many, but it’s a dream very often relies on protecting the desired capital. They usually comes to navigating an intricate network regarding financial hurdles. One of the several challenges out of manager-building are protecting investment for the enterprise. Rather than traditional homebuyers, owner-builders deal with unique standards and you will possible hurdles whenever applying for loans. This web site blog post gives you beneficial knowledge towards the unique capital landscape inside Texas and offer important ideas to help your contain the financing needed to bring your dream the place to find life.

One of many benefits associated with strengthening your home within the Texas ‘s the protection provided by Colorado Homestead Work. It rules covers most of your home out-of creditors, bringing an economic safety net in case there are unanticipated points. Yet not, it is critical to understand how the latest Homestead Work communicates which have investment solutions.

Navigating the industry of funds, rates of interest, and lender requirements are daunting, particularly for very first-big date owner-builders

- Protecting Your own Collateral: New Homestead Operate implies that your own equity on the number one household tends to be excused away from creditors’ says. Because of this very variety of debts do not push the selling of your own homestead property in order to meet those individuals personal debt. That it shield is especially rewarding throughout the financial hardships otherwise case of bankruptcy legal proceeding, making it possible for home owners to maintain their number one quarters. This might be a secured asset whenever trying financial support for your owner-builder opportunity.

- Influence on Credit: While the Homestead Act covers your collateral, it may dictate the latest small print of mortgage. Lenders possess certain standards concerning your papers of the homestead status to be sure compliance that have Texas laws.

When you look at the Tx, lenders require a Builder out-of Listing to be active in the design process. So it demands essentially means that a creator have to be involved in the project so you can manage design.

Navigating the industry of fund, rates, and you will financial standards will likely be overwhelming, especially for basic-day proprietor-designers

- Knowing the Character: The new Creator out of Listing is responsible for making certain the construction enterprise adheres to building requirements and you can statutes. They act as a beneficial liaison amongst the bank in addition to proprietor-builder.

- Interested in a creator out of Record: If you’re not at ease with the very thought of hiring a general contractor, you may have to look for a qualified individual or company so you’re able to play the role of the fresh Creator off Number. This is when Mainly based Environmentally friendly Personalized Belongings steps in to help your.

The new Creator regarding List demands is primarily intended to protect lenders. Insurance firms a builder active in the investment, lenders normally mitigate the exposure and ensure your design are being done securely. Additionally, it will bring a number of guarantee to your financial one to the project would be accomplished on time and you will in this budget.

Because the Builder out of Number needs could add an extra level out of complexity to the owner-builder process, it has been an essential https://paydayloansconnecticut.com/ updates to possess getting funding. It may also render peace of mind on owner-creator, realizing that a qualified elite group are assisting to supervise the construction project.

Rates enjoy a vital role from the overall cost out-of your own holder-builder enterprise. When you are down rates of interest can reduce your own monthly installments, it is essential to take into account the total cost of your financing more its name. Here are a few points to remember:

Navigating the world of loans, rates of interest, and you will lender conditions are going to be challenging, particularly for earliest-time manager-developers

- Mortgage Identity: A longer mortgage identity may cause down monthly payments but may also increase the overall cost of the loan on account of attention accrual.

- Down-payment: A much bigger advance payment makes it possible to safer a lower life expectancy desire price and reduce the entire price of the loan.

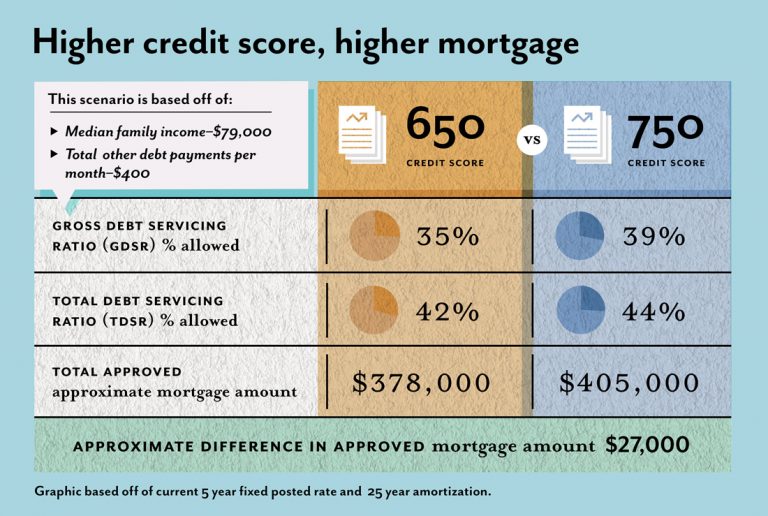

- Credit score: Your credit rating is a huge reason for choosing the interest speed it is possible to qualify for. Boosting your credit score before applying for a loan may lead to raised words.

Below are a few basic tips to make it easier to browse the credit surroundings and increase your odds of securing a loan for the Texas owner-builder investment:

Navigating the field of funds, interest rates, and you will bank criteria might be daunting, especially for earliest-date owner-developers

- Initiate Early: Initiate debt thought well in advance supply your self big time for you to save yourself for an advance payment and you will change your borrowing from the bank rating.

- Believe Pre-Approval: Receive pre-approval away from a lender before starting the shape procedure. This will leave you a better notion of your budget and you can help you to stay in this that funds as your plans create.

On Situated Green Personalized Home, we realize the problems regarding securing financing for the Colorado proprietor-builder project. All of us out-of positives will provide beneficial pointers and service throughout the the process. Since your Builder out-of Listing, we help you browse the complexities of your Texas Homestead Act and make certain compliance with all expected statutes.

I in addition to assist you in finding the best option money possibilities, discussing that have lenders, and you will dealing with their project’s economic facets. With our options and you may dedication to your success, you could work on building your perfect family once we manage the latest financial details.